Coronavirus & Oil War - The Bitter Sweet Mix

- Ogechi Aguma

- Feb 26, 2020

- 3 min read

Updated: Sep 19, 2020

The global village is being squeezed by Coronavirus. Government of countries are running strategic schemes; infusing stimulus into their local economy to attract global market funds, health care infrastructures to nurse the affected & infected, setting up committees to develop economic recovery plans for the short term and long term. All gradually trying to nurture the economy back to normalcy, then ego throws in another 'Black Swan' - Oil war.

Oil hitting its Feb 2016 and Dec 2008 lows. This is creating panic in the markets. Traders are hitting the buy and sell buttons due to strategy reshuffling.

Heads - Bitter Taste

The mix, very bitter and sending the global market to it's lowest past, regions long forgotten. Remember most earnings report are not in yet. The recovery from one of the biggest single day Market Cap drop in the US in 2018. China trade war was just shading a glimmer of brightness leaving the past behind before this mix.

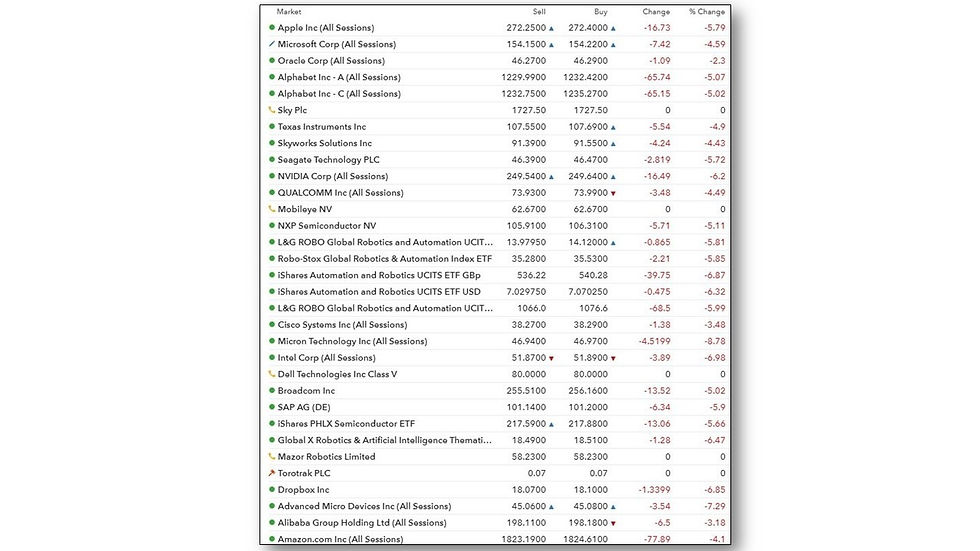

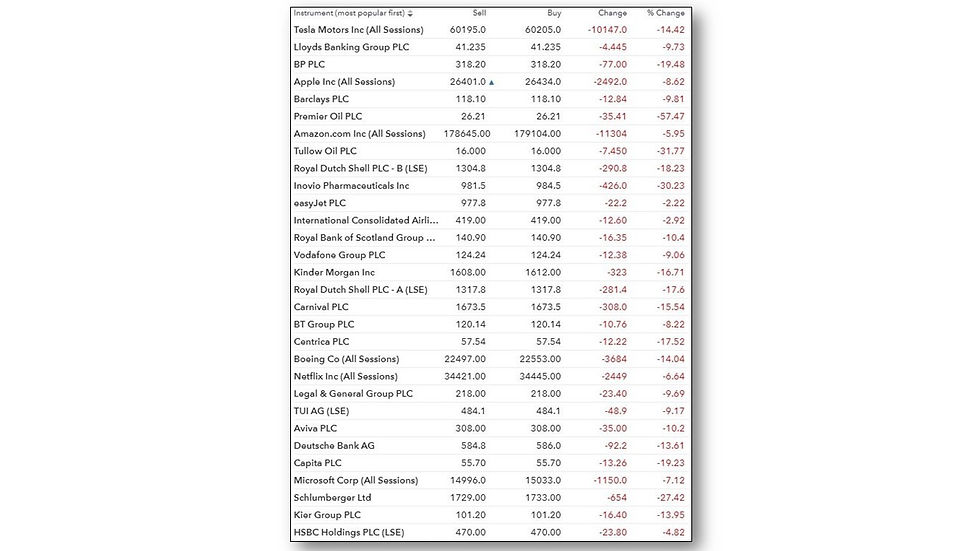

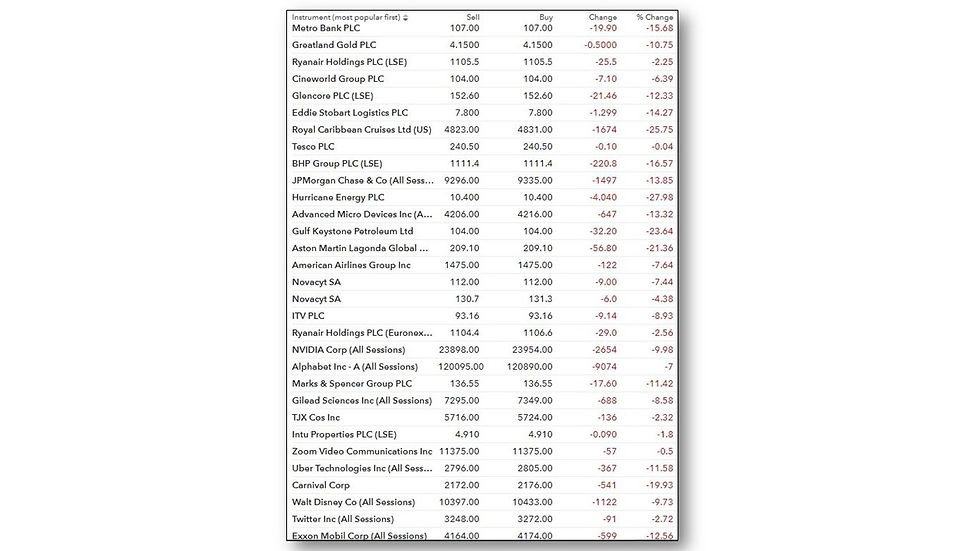

Market caps of major companies again are been slashed. For Small Cap companies, one can only imagine right now how tight their brace straps would be. Check % change of stocks mid afternoon today.

Financial Analyst, Hedge fund managers, CFO's are all trying to piece it all together. What will be the final picture of this puzzle when its all done.

Table below shows end of play market sell-off 09.03.2020. See last column - % change.

Tales - The Flip side

Looking on the bright side of events, one can only call this season a period of SALES!!!

Time to shop for the right discounted stocks.

Cash now, i mean right now, seems to have great purchasing powers giving it the Kingship title - ‘Cash is King’. The mix of both Black Swans seems sweet to value investors. This period could been seen as an opportunity to invest in stocks having the potential to rise with economy recovery.

Wars have endings, diseases will come and go, same as companies. Now, here comes the endurance race of survival. The company with the most robust strategy, recovery plan, foresight and clear focus on simplifying the chores of man (the global world) are bound to come out strong.

Investing in value will pay out good dividend in the long term. Keep a look out and get your money working this period. The employment opportunities for money in the Stock market are numerous right now. Get it interviewing and gainful pulling its weights!

Check out Warren Buffett's portfolio Tracker.

Watch and Subscribe to our YouTube channel for more insights

Subscribe to our website for updates.

Click on Log in (Top right).

Recommended online Brokers

Hargreaves and Lansdown. Take a look at their fees.

Degiro - Especially for those living in Europe for examples Portugal. Take a look at their fees.

Bamboo App - Especially for those in Africa.

Do your research.

Counsel

Always try to buy stocks when they are on SALES! (basically when there is a dip in the share price).

Drip feed your investments. Share prices vary day to day especially in times economic crisis, high volatility becomes a common theme. In the same vain, be watchful of purchasing fees.

Investopedia is a great website to help you with understanding almost any financial terms and definitions.

Disclaimer

Note: Shares and Investment Lifestyle website is only for information purposes. Please do your detailed research. Any investment decision taken will solely be your responsibility. You can get back more or less capital than you invest.

Comments